There’s no doubt that the recession forced many private golf club members to take a serious look at the dues they paid, relative to the number of rounds they played at their club. Even in good times, the thought of dividing annual dues by the number of visits would trigger an ostrich-like denial: “I just don’t want to know.”

However, many of the two million+ golfers with memberships in private golf and country clubs continue to be willing to overlook high cost-per-visit numbers. This is likely because they believe the costs are outweighed by the inherent benefits: exclusivity (Groucho Marx famously said he’d never want to join a club that would accept him as a member), convenience to home, better conditioning, high-end amenities, dining/socializing, family-time, faster play, business/community networking and prestige, among them.

It’s only logical that when job security and personal financial health came under recession-driven threat, pressure on discretionary spending ramped up. Such dynamics forced many golfers to reconsider how club memberships fit into their lives, and their finances. Some resigned their memberships.

But new NGF research shows that the vulnerability of current private club memberships may have peaked – and lapsed club members who resigned memberships under the financial pressures of the past four-to-six years now appear to be reconsidering their non-member status.

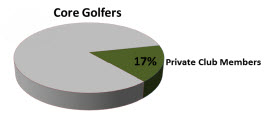

Recent NGF research shows that approximately 17% of Core Golfers hold memberships at private golf clubs.

Recent NGF research shows that approximately 17% of Core Golfers hold memberships at private golf clubs.

When asked about their likelihood to maintain their memberships for the next three years, 94% felt confident they would (Top 2 Box ratings: Extremely or Very likely). This leaves only 6% of current members somewhat vulnerable – or in a group that doesn’t feel completely confident they will retain their private club memberships in the next few years (Somewhat, Not very or Not at all likely).

Vulnerability appears highest among members who play large percentages of their rounds away from their club. Within the group of members who play 40% or more of their rounds away from their club, 15% are classified as vulnerable. This reinforces the need for clubs in areas saturated with quality public access golf to work harder to retain members and increase club utilization, perhaps through facilities and benefits that go beyond golf.

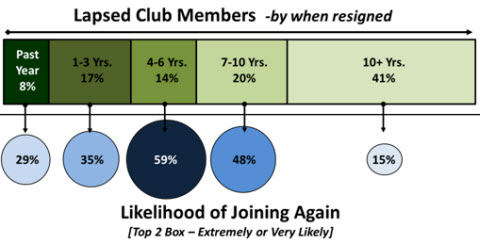

Likelihood of Lapsed Club Members to Join Again

NGF also studied responses from those who were members of private golf clubs in the past. Some interesting perspectives emerged when we segmented these lapsed club members based upon how long ago they resigned their memberships.

Those who resigned their membership 4-6 years ago show the highest likelihood of joining again in the future (59%).

This begs the question… what is different about this group? In looking at a selection of the verbatim reasons given for resigning memberships during that time period, the most often mentioned reasons focused on financial distress:

-“I lost my job”

-“Financial hardship”

-“2008 financial crisis”

-“Money, the cost was just too high for the times”

These were golfers whose decision to resign their golf membership was highly influenced by recessionary circumstances. This group of lapsed Club members will represent a significant target market for private clubs in the next few years, provided the economy and personal financial situations are stable or improve.